🔥 This offer expires in:

🔥 This offer expires in:

For everyday earners unknowingly stuck in the bank’s game...

30 Practical Tactics

To Escape the $24,718 Trap and Achieve Financial Freedom

Without chasing get-rich-quick schemes, trusting smooth-talking advisors, or obsessing over market trends—this guide gives you practical, proven steps to break free from debt and take control of your financial future.

4.8 / 5 based on 1,931 reviews

JOE NORRIS

TEACHER & DAD OF 3

"I used to feel completely trapped—juggling bills, drowning in hidden fees, and never making real progress. I thought I was ‘managing’ my money, but in reality, I was just stuck in a cycle I didn’t understand. This guide changed everything. One simple shift saved me more than the cost of the book, and now I finally feel in control of my finances. No more guesswork, no more anxiety—just a clear path forward."

INTRODUCING THE CRUSH YOUR DEBT PDF

8 in 10 People Stay Trapped in Debt While Banks and Inflation Drain their Hard-Earned Money—It's Time to Break Free!

Is Your Debt Keeping You Stuck?

Every year, millions of people struggle to get ahead—not because they don’t earn enough, but because debt and hidden fees quietly drain their income.

You make payments, but high interest rates and rising costs keep you trapped, making real progress feel impossible.

Meanwhile, banks profit from your debt, charging you steep interest while offering pennies on your savings. The system isn’t designed to help you—it’s designed to keep you paying.

This guide gives you a way out. Instead of staying stuck in the cycle, you’ll learn practical, proven tactics to take back control, eliminate debt faster, and start building real financial security—without relying on risky investments or complicated strategies.

It’s time to stop working for the banks and start making your money work for you.

Avoid a 3% Annual Erosion

Debt isn’t just a burden—it’s a drain on your future. With high interest rates piling up, every dollar you earn loses value before you can even put it to good use. This guide reveals smart, practical strategies to escape the debt trap faster, so you can finally keep more of your money instead of watching it disappear month after month.

Same Access As The Top 1%

The wealthy don’t stay trapped in debt—they use strategies that keep them ahead while others struggle. This guide uncovers practical methods to break free from the cycle of high-interest payments and take control of your finances, using tactics that don’t require a six-figure income or years of experience.

Flip The Script On The Banks

Ever notice how your debt keeps growing while your bank balance barely moves? That’s because lenders charge you sky-high interest while offering you next to nothing in return. This guide shows you how to flip the script—cut down debt faster, keep more of your income, and stop letting the banks profit off your hard work.

Crush Your Debt In Under 5 Minutes A Week

Breaking free from debt doesn't have to feel like scaling Mount Everest. While financial institutions often shroud their practices in complexity (it serves their bottom line, after all), taking control of your financial future is simpler than you might think. In this guide, I'll show you how to transform your relationship with money and crush your debt with just 5 minutes of effort each week – no fancy jargon or complicated spreadsheets required.

Exclusive Bonuses Just For YOU!

Along with this debt-crushing blueprint, you'll receive a powerful toolkit of resources and information worth over $500 – completely free. These carefully curated bonuses aren't just random add-ons; they're essential companions designed to accelerate your journey to financial freedom:

BONUS 1: The Top Apps to Aid You on Your Journey

A suite of user-friendly budgeting apps that make tracking your spending feel effortless.

BONUS 2: Never Too Much Support

Access to private support communities where thousands of others share their debt-free journeys

BONUS 3: Tools, Tools, Tools

Our handpicked collection of wealth-building tools that the banks don't want you to know about

BONUS 4: Don't Work Harder, Work Smarter

Exclusive access to expert-led workshops on advanced debt elimination strategies

BONUS 5: More Templates and Resources Than Ever

Many Websites, planning resources and templates to optimize your debt payoff schedule

REAL SUCCESS, REAL PEOPLE

Join Our Community of Success Stories

Verified Review

SARAH LEWIS

Small Business Owner

"I thought I was doing everything right—cutting expenses, making payments, trying to get ahead. But this ebook? It opened my eyes. I realized I was stuck in a cycle, barely keeping up, instead of actually breaking free. Now, I see a clear way out—moves I didn’t even know existed. Just started applying what I learned, and I already feel like I’m finally in control. Worth every penny."

Verified Review

DAVID CHEN

Engineer & Investor

"I always wanted to get out of debt, but it felt overwhelming—so much advice, so many ‘experts,’ and no clear path. This ebook changed that. It breaks everything down, step by step, in a way that finally makes sense. Now, instead of just treading water, I’m actually making real progress. One month in, and I already feel lighter, like I’m finally moving forward instead of sinking."

Verified Review

EMILY REED

Freelancer & mom of 2

"High interest, endless payments... I was barely making a dent. I didn’t even realize how much of a trap I was in until I read this. Just one move from this ebook saved me what it cost—probably more. For the first time, I feel like I’m in control instead of drowning in bills. Total game-changer."

Verified Review

ROBERT MARTIN

Self-employed entrepreneur

"I used to feel, well... totally clueless about getting out of debt and where to start. Then I got this guide, and boom—direction. It’s like having a road map for my money. My biggest regret? Not getting this sooner. Seriously, if you’re looking to break out of that paycheck-to-paycheck cycle, this is it."

Verified Review

JASMINE PATEL

College student & part-time worker

"People always say, ‘Just pay off your debt!’ but no one tells you how to actually escape the cycle for good. This ebook changed that. I’m starting small, but even now, I can see the difference—it’s actually working. For the first time, I feel hopeful about my finances instead of stressed."

Verified Review

MICHAEL GONZALEZ

Marketing professional

"I spent years trapped in the debt cycle, making minimum payments and thinking that was just ‘normal.’ Wrong. This ebook opened my eyes. Now, I’m actually seeing my money work for me instead of vanishing into interest payments. If you’re on the fence, get off it and grab this. It’s already paid for itself—trust me."

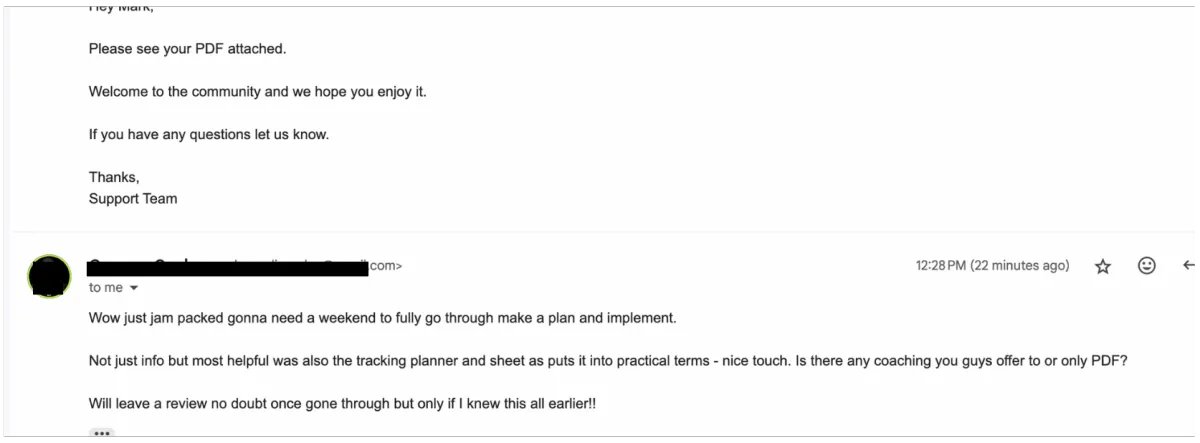

Want More? People Just Like You Send Us In This Everyday...

4.8 / 5 based on 1,931 reviews

READY TO GET STARTED?

Get The Crush Your Debt PDF Today!

With this bundle, you’ll get instant access to powerful strategies to break free from debt and finally take control of your finances. For a limited time, grab this step-by-step guide at a price that pays for itself. Don’t stay stuck in the cycle—this is your chance to escape the stress and start building real financial freedom.

CRUSH YOUR DEBT PDF

$17 USD

VAT/Tax Include

4.8 / 5 based on 1,931 reviews

Full Comprehensive CRUSH YOUR DEBT PDF

BONUS 1: The Top Apps to Aid You on Your Journey

A suite of user-friendly budgeting apps that make tracking your spending feel effortless.

BONUS 2: Never Too Much Support

Access to private support communities where thousands of others share their debt-free journeys

BONUS 3: Tools, Tools, Tools

Our handpicked collection of wealth-building tools that the banks don't want you to know about

BONUS 4: Don't Work Harder, Work Smarter

Exclusive access to expert-led workshops on advanced debt elimination strategies

BONUS 5: More Templates and Resources Than Ever

Many Websites, planning resources and templates to optimize your debt payoff schedule

Still Got Questions?

Here's The Answers

What exactly will this guide teach me?

This guide will show you exactly how to escape the cycle of crushing debt and take back control of your finances. You’ll learn step-by-step strategies to stop drowning in interest, pay off what you owe faster, and start building real financial stability—without feeling overwhelmed. If you’re tired of living paycheck to paycheck and want a clear path to freedom, this guide is for you.

Is this guide suitable for beginners?

Absolutely! This guide is designed for anyone struggling with debt, even if you have zero financial knowledge. It breaks everything down in simple, easy-to-follow steps—no confusing jargon, no complicated strategies. Whether you're just starting to take control of your finances or you've tried before and felt stuck, this guide will give you a clear, realistic path to finally getting out of debt for good.

Do I need a large amount of money to start?

Not at all! Many of the strategies we share are suitable for any budget. You’ll learn techniques that you can start with a small amount of money and grow over time.

How quickly can I see results?

How fast you see results depends on your situation, but many readers start feeling a difference almost immediately. From the moment you apply the strategies in this guide, you’ll begin to take control—whether that’s cutting down interest, freeing up cash, or making smarter money moves. Some see noticeable progress within weeks, while others experience life-changing shifts in a few months. The key is taking action, and this guide makes it simple to start right away.

Will this guide work for me if I’m already managing my debt payments?

Yes! Even if you’re keeping up with your debt payments, this guide will show you how to pay them off faster, reduce interest, and stop wasting money. Instead of just managing debt, you’ll learn how to eliminate it for good—without feeling stuck in a never-ending cycle. If you’re tired of making payments month after month with little progress, this guide will help you take control and finally get ahead.

What resources come with the guide?

Along with the main guide, you’ll get a professional vision board worksheet, a 30-day $1,000 saving challenge, a list of top tools, book recommendations, a high quality money mindset worksheet, and debt snapshot worksheets—all designed to support you in taking action and getting your life back!

How is this different from free advice I can find online?

This e-book offers more than generic online advice by providing a personalized, actionable plan tailored to your unique debt situation. It goes beyond surface-level tips with expert insights, a comprehensive strategy, and practical tools to help you take real steps toward financial freedom. Unlike free resources, this guide gives you a clear, step-by-step roadmap to tackle debt effectively and build a solid financial future.

Is there a guarantee if I’m not satisfied?

While we can’t offer refunds on digital products, we’re confident in the value this guide brings. The strategies inside are designed to help you reduce your debts and grow your money—many users report getting more than their money’s worth within days of implementing the tips.

4.8 / 5 based on 1,931 reviews

All rights reserved Crush Your Debt Ltd

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.